Calculate my borrowing power

Use our free mortgage calculator to estimate your monthly mortgage payments. The borrowing amount is a guide only.

Where Art Thou Plot Of Dirt Residential Land Commune The Borrowers

It only takes about 20 minutes to complete our online application form.

. To ensure that all Wikipedia content is verifiable Wikipedia provides a means for anyone to question an uncited claimIf your work has been tagged please provide a reliable source for the statement and discuss if needed. Rates and repayments are indicative only and subject to change. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. With you every step of your journey. Results are based on a loan term of five years and assumes the interest rate does not fluctuate for said term.

However whether this improves or adheres your borrowing power will depend on many things like whether the property is positively or negatively geared the property value and your current loan. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Central banks attempt to limit inflation.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. John and Janes expenses Our hypothetical couple are 30-year-old newlyweds John and Jane. What is an Interest Rate.

Get my rate apply. Weve assumed a 250 interest rate and a 30-year loan term. This calculator helps you work out the most you could borrow from the bank to buy your new home.

The Borrowing Power Calculator provides you with an estimate of how much you may be able to borrow for a car loan based on what you can afford to repay. Inflation is the rate at which the general level of prices for goods and services is rising and consequently the purchasing power of currency is falling. What is the value of my business.

Borrowing Power With Serviceability Buffer At 25 and 3. Account for interest rates and break down payments in an easy to use amortization schedule. Yearly Income Interest Rate Borrowing.

Compare home buying options today. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Get an estimate in 2 minutes Ready to get started.

Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. It doesnt take into account loan eligibility criteria or your complete financial position. You can also use our How much can I borrow calculator to determine your borrowing power.

The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator. In case you additional materials for your assignment you will be directed to manage my orders section where you can upload them. Before sharing sensitive information make sure youre on a federal government site.

2 days agoThis means that if you apply for a home loan with a 25 interest rate the bank will calculate your repayments as if the interest rate were 55 previously it would have been just 5 when deciding whether to approve you for the loan. Think of a RenoFi Loan as having the borrowing power of a home renovation loan with the ease of a home equity loan or cash-out refinance. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

The information needed include. You can add a citation by selecting from the drop-down menu at the top of the editing boxIn markup you can add a citation manually using ref tags. This is largely made up of your income your financial commitments current savings and your credit history.

An interest rate refers to the amount charged by a lender to a borrower for any form of debt given generally expressed as a percentage of the principal. The gov means its official. Federal government websites often end in gov or mil.

Personal loan borrowing power calculator. The best way to find out is to chat to a Home Lending Specialist who can give you a better idea based on your circumstances. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Calculate how much you can borrow to buy a new home. The calculator will tell you the average monthly payment and calculate the total interest paid over the term of the loan. Borrowing power calculation does not constitute a loan offer.

You can use a loan repayment calculator to try similar calculations based on your needs. This is called your borrowing power. A constructive and inclusive social network for software developers.

Please read the Calculator Assumptions and Disclaimers for more information. This factor can increase borrowing power by more than 11x while also ensuring that the lowest possible interest rate is secured. Calculate This information may help you analyze your financial needs.

Disclaimer - Borrowing power. This will help you get a better idea of what. It is based on information and assumptions provided by you regarding your goals expectations and financial situation.

Get 247 customer support help when you place a homework help service order with us. Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style. Input the principal amount of the loan the period of the loan in months or years and the interest rate of the loan.

You also give your assignment instructions. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years.

We have also made a number of assumptions when estimating your borrowing power and those assumptions affect how reliable this estimate is. The asset borrowed can be in the form of cash large assets such as vehicle or building or just consumer goodsIn the case of larger assets the interest rate is commonly referred to. How much can I borrow.

The amount you may be able to borrow is determined by your financial situation. Book an appointment with your NAB banker to discuss your options.

Financial Loan Calculator Estimate Your Monthly Payments

How Much Can I Borrow Home Loan Calculator

Mortgage Calculator Money

Lvr Borrowing Capacity Calculator Interest Co Nz

How To Get Collections Off Credit Report Revealed Revealed How To Get Col Paying Credit Repair Companies Best Credit Repair Companies Credit Repair Letters

What Is Simple Interest Internal Control Business Analyst Simple Interest

5 Best Mortgage Calculators How Much House Can You Afford

Home Affordability Calculator Credit Karma

How Much Can I Borrow Home Loan Calculator

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips

Simple Loan Calculator Credit Karma

/f/84672/1160x565/3c7ee84a24/how-do-you-calculate-borrower-power.jpg)

How Do You Calculate Borrowing Power

![]()

7 Top Student Loan Calculators That Do Money Saving Math For You Student Loan Hero

Loan Calculator That Creates Date Accurate Payment Schedules

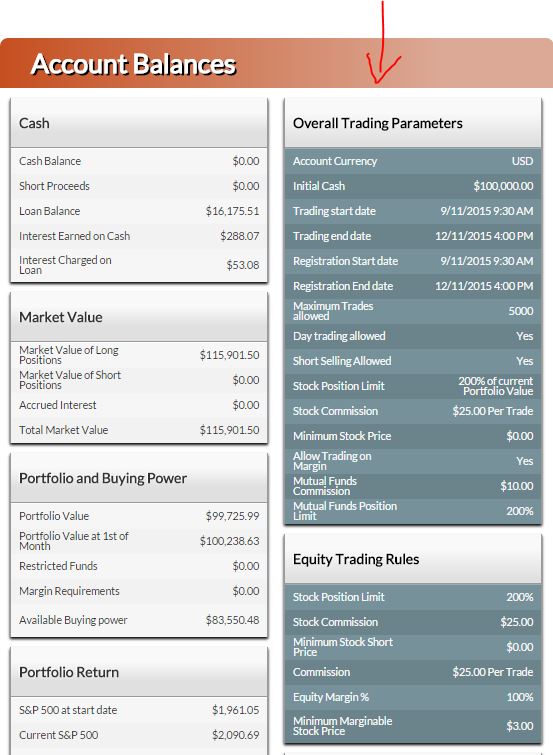

How Is My Buying Power Calculated Personal Finance Lab

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

Mortgage Calculator How Much House Can You Afford Finder Com